Understanding Risk and Return Balance in Investing

Success in the investment world doesn’t just depend on achieving high returns it also requires effectively managing the balance between risk and return. This is where the Sharpe Ratio, developed by William Sharpe, comes into play. This ratio measures the risk-adjusted performance of your investment portfolio, showing how much return you gain for the risk you take. If you want to evaluate investment opportunities more consciously, this article will explore Sharpe Ratio scanning and its applications on the TradingView platform.

In this blog post, we’ll dive deep into the content shared by Mr.Rakun on the X platform and explain how you can integrate this information into your investment strategy.

What Is the Sharpe Ratio and Why Is It Important?

The Sharpe Ratio is a performance metric that evaluates an investment or portfolio’s return on a risk-adjusted basis. It is mathematically expressed with the following formula:

Sharpe Ratio = (Portfolio Return – Risk-Free Rate) / Portfolio Standard Deviation

This ratio indicates how much excess return you earn per unit of risk. A higher Sharpe Ratio suggests a better risk-return balance. For investors in crypto, stocks, and other financial markets, this ratio is a critical tool in the decision-making process.

Benefits of the Sharpe Ratio

- Risk-Adjusted Performance Measurement: It focuses not only on returns but also on risks.

- Investment Comparison: Allows you to compare different portfolios or assets on a risk-adjusted basis.

- Portfolio Optimization: Helps you optimize your asset allocation.

How to Perform a Sharpe Ratio Scan on TradingView

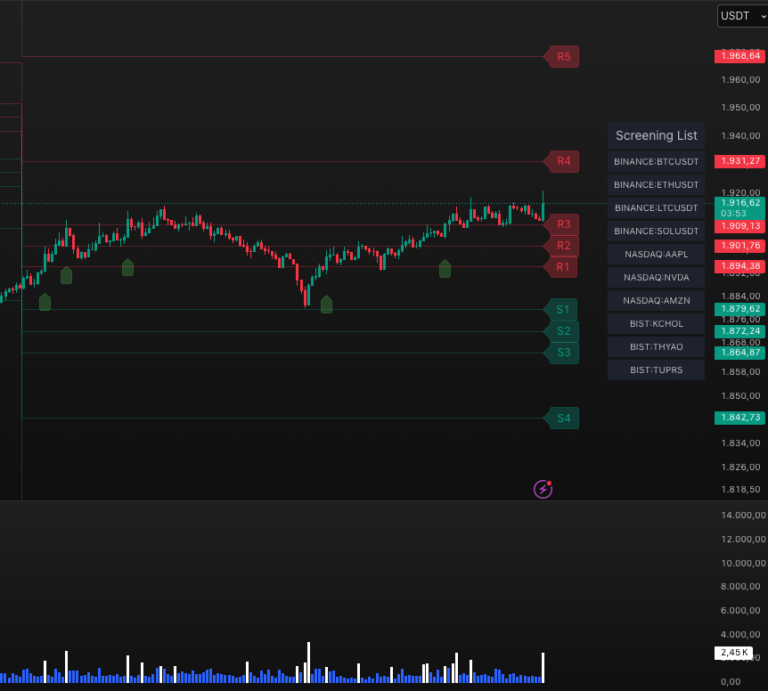

TradingView is a powerful analysis platform for investors and traders. The visuals and explanations shared by Mr.Rakun on X demonstrate how to conduct a Sharpe Ratio scan on this platform. The original indicator and its modified version for scanning are presented as ideal tools for identifying investment opportunities.

Step-by-Step Sharpe Ratio Scanning

- Log in to Your TradingView Account: Sign up for the platform or use your existing account.

- Explore Indicators: In the “Indicators” section, search for tools related to the Sharpe Ratio. As Mr.Rakun shared, you can access the original Sharpe Ratio indicator and customize it to your needs. You can also check the modified scanning version here.

- Activate the Scanning Feature: Use TradingView’s scanning tools to filter stocks, cryptocurrencies, or other assets based on a specific Sharpe Ratio threshold.

- Review Risks: Before investing, as Mr. Rakun emphasized, always assess your risks. Remember that every investment carries its own unique risks.

This scan on TradingView can be applied to both the U.S. stock market and international markets. As noted in the post, the indicator works across markets, regardless of the asset type.

Using the Sharpe Ratio for Crypto and U.S. Stock Investments

In the visuals shared by Mr. Rakun, the Sharpe Ratios of cryptocurrencies (e.g., BTC/USD, ETH/USD) and other assets on Binance are detailed. This helps investors understand which assets offer a better risk-return balance.

Sharpe Ratio for Cryptocurrency Investments

Since cryptocurrency markets are inherently volatile, the Sharpe Ratio is particularly useful in this space. By analyzing your portfolio’s risk-adjusted performance before investing, you can make more informed decisions.

Sharpe Ratio for U.S. Stock Investments

In the U.S. stock market, the Sharpe Ratio can also be used to evaluate stock performance. The scanning option for U.S. markets, as implied in the post, offers a significant opportunity for American investors.

Things to Consider Before Investing

As Mr. Rakun highlighted in his X post, always review your risks before making any investment. While the Sharpe Ratio is a powerful tool, it isn’t sufficient on its own for making investment decisions. Follow these steps to develop a safer strategy:

- Conduct Research: Analyze the historical performance and market conditions of the assets you plan to invest in.

- Diversify: Reduce risk by diversifying your portfolio.

- Seek Expert Advice: Consult financial experts or trusted sources for guidance.

Additional Resources for TradingView and the Sharpe Ratio

For more information, check out the following resources:

- TradingView Official Website – Detailed information on indicators and scanning tools.

- What Is the Sharpe Ratio? – Investopedia – A theoretical explanation of the Sharpe Ratio.

- CMC Markets – Sharpe Ratio Calculation – Practical applications and examples.

Conclusion: Smarter Investments with the Sharpe Ratio

The Sharpe Ratio is a powerful tool for understanding the risk-return balance in the investment world. The ability to scan and analyze this ratio on the TradingView platform offers a significant advantage for both beginners and experienced investors. Mr. Rakun’s shared content serves as an inspiring example of how to use this tool effectively.

If you want to explore investment opportunities and optimize your portfolio, visit TradingView today and check out the original Sharpe Ratio indicator or the modified scanning version. However, always assess your risks and take informed steps.

Frequently Asked Questions (FAQ)

- How is the Sharpe Ratio calculated? The Sharpe Ratio is calculated using the portfolio return, risk-free rate, and the portfolio’s standard deviation. For more details, refer to the resources above.

- Can I perform a Sharpe Ratio scan on TradingView? Yes, you can find this indicator on TradingView and customize it for market scans.

- In which markets can the Sharpe Ratio be used? It can be applied to cryptocurrencies, U.S. stocks, forex, and other financial markets.

Share this post or leave a comment with your thoughts! Follow our blog for more finance and investment content.